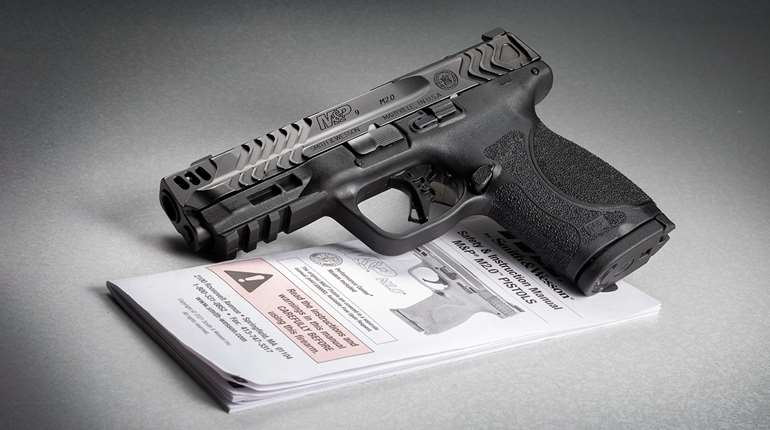

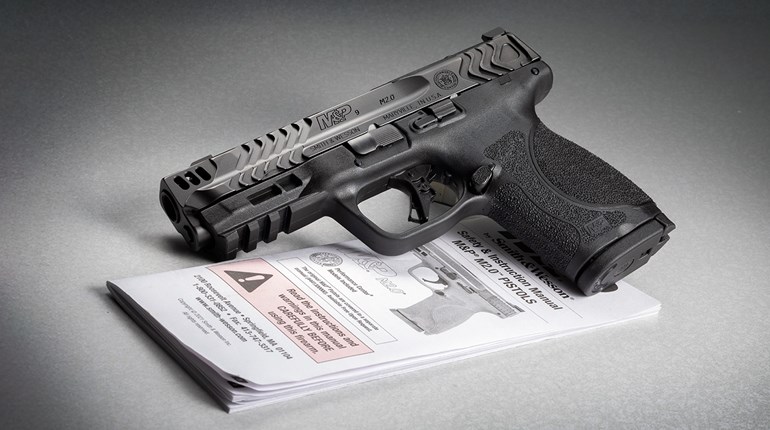

A proposal to tax guns and ammunition, initiated by Cook County Board President Toni Preckwinkle, would ostensibly add tax revenue to help close the county's mounting $115 million budget shortfall for 2013, as well as to decrease the sales of firearms in suburban guns shops, supporters say.

But critics of the idea, including the Illinois State Rifle Association, describe the effort as merely the latest misstep in the city's long history of misplacing the blame for Chicago's record crime and firearms-related violence.

"As with the county board's past gun-control schemes, this firearm and ammunition tax is just a smokescreen designed to obscure the fallout from ineffective government," read an Illinois State Rifle Association (ISRA) statement released this week. "Estimates are that about 90 percent of those people who commit murders in Cook County have previous criminal records. Likewise, estimates indicate that about 75 percent of murder victims have criminal records as well. These numbers are an indictment of the Cook County courts and the county's correctional system."

This week, the Chicago Sun-Times reported the city is currently on track toward a record amount of crime for the year and its jails are nearing capacity. For 2012, murders are up 25 percent over last year, according to recent police statistics, and the county jail is filling up—with 9,000-plus inmates in a system with a capacity of 10,155.

It's not the first time a tax on ammunition has been proposed in Chicago. In 2007, then Cook County Commissioner Roberto Maldonado—now a Chicago alderman—campaigned for a 10-cent-per-bullet tax, and even proposed charging 50 cents, before the proposal was ultimately shelved.

The bottom line, say opponents of a so-called "violence tax," is such an increase would do nothing to stem the city's crime or to prevent its criminal element from obtaining firearms and ammunition illegally. Instead, it would place an unreasonable burden on law-abiding gun owners who purchase firearms and ammunition to protect themselves, their property and their families.

"Whether board president Preckwinkle likes it or not, the demand for firearms and ammunition by law-abiding citizens remains strong—in great part due to the failure of the county to keep its streets safe," said the ISRA. "Imposition of this punitive tax on guns and ammunition will do nothing to stem that demand. The reality is that lawful firearm dealers will avoid the tax by moving out to the collar counties and take their law-abiding customers with them. And with their customers will go hefty sales tax receipts that far out strip any revenues that the firearm 'sin tax' would generate."